The way to get anybody else away from an action otherwise financial

Most people going through a splitting up or a personal bankruptcy look for answers on how to eliminate the ex from the deed and you will home loan away from a home, condominium, and other possessions.

Very first, we have to comment the difference between this new action and home loan. A deed is a file one to entitles anyone to an effective in our home and also to your house. A man ple, a father or mother could possibly get put a good son for the action in order that the house or property will get admission toward child upon brand new mom’s passing. Some days, good elizabeth of your own deed showing that house is together shared by both of them.

Home financing, additionally, ‘s the bargain having duty to invest your debt owed into the the property. The mortgage ‘s the full debt due and more than anybody generate monthly premiums on the prominent balance, the pace, and frequently the home taxes and you may homeowners’ insurance rates (identified together because the escrow).

If you are on the mortgage, this won’t necessarily mean you’re on the brand new deed. When you find yourself on the action, you do not get on the borrowed funds. You will need to review both records truly observe what their name is listed on.

The one who is going to refinance will need to make sure the credit history and you will credit score are located in sound condition before trying this

- They transfer the home to you

- You import the property in it

Most of the time, property is going to be moved of the signing a file titled a stop Allege Deed. You ought to speak to a real property attorneys who is experienced and proficient in getting ready Quit Claim Deeds. The newest End Allege Deed tend to transfer the property regarding all of your brands with the one of your names. After that, new document is filed on your county’s property records and another people becomes the official holder of the home.

Looks simple, best? It can be. Yet not, it could also be problematic if you have collateral about property. For people who purchased the home to own $200,000, nevertheless now the property is really worth $275,000, him or her may think they need to found part of the security from the increased worth of our home. Inside our example, in the a florida divorce proceedings should your family is actually ordered into the marriage, a wife will be permitted half of the latest security out of the home or $37,five hundred (security from $75,000 split up by dos). A partner may well not need to import the home to you personally in place of some compensation.

The other situation you certainly will develop if your ex lover is on brand new deed additionally the home loan. It would perhaps not sound right for the ex to sign off on the legal rights in order to property, but then be in charge and accountable for owing money on the home they not features legal rights so you can. A good buy attorneys perform recommend against signing away from towards the name into the household whether your body’s nonetheless compelled to the home loan.

The person who is about to re-finance should make yes their credit history and you may credit score are in sound condition before attempting this one

- Repay your debt

- Re-finance the house

- Sell the house or property

- Document Case of bankruptcy

Pay back the debt When you pay off your debt in full, there won’t be any mortgage. The lending company have a tendency to file a notification from Pleasure out of Home loan with your own county’s possessions info and it’ll let you know there isn’t any extended home financing to your property. After there’s absolutely no financial, you simply take care of in case the other individual is found on the fresh action or not (see more than).

The likelihood of an ex lover paying down a home loan while going courtesy a break up, shopping for an alternative location to real time, etc. is normally low. This isn’t a common solution. Although not, if you are planning by way of a separation and you are receiving a lump sum payment payout (alimony, later years account delivery, etc), this may be a chance. Settling the debt eliminates the brand new monetary liability both for off your towards property.

Refinance the house A more common choice is to refinance the house. The person who is going to keep the possessions will require to refinance the borrowed funds and refinance they into their identity just. On the other hand, the individual remaining our home needs for a powerful works records (at the very least 2 yrs at the same place), duplicates of their tax returns, and you will proof of their paystubs and you will income. A structured individual with their monetary data files ready to go is a much better candidate to possess re-finance.

Sell the house or property Without a popular suggestion, if you’re unable to pay off or refinance the borrowed funds, another reasonable choice is to offer the house. Attempting to sell the house will likely then allow you to repay the newest financial and you will sever every ties anywhere between both you and your ex. Whenever you are no further economically tied up courtesy a home loan, you can leave that have a fresh begin. After you sell https://paydayloancolorado.net/iliff/ the property, the mortgage becomes paid back additionally the action often move into the latest citizens. This can be an opportunity to target one another factors (deed and you may home loan) because of one to purchase.

And also this ensures that one another do will still be entirely accountable on financial

*Bonus: In case your household enjoys guarantee inside it, your ex might be able to split almost any is actually leftover to start a new lives and you can house having some money.

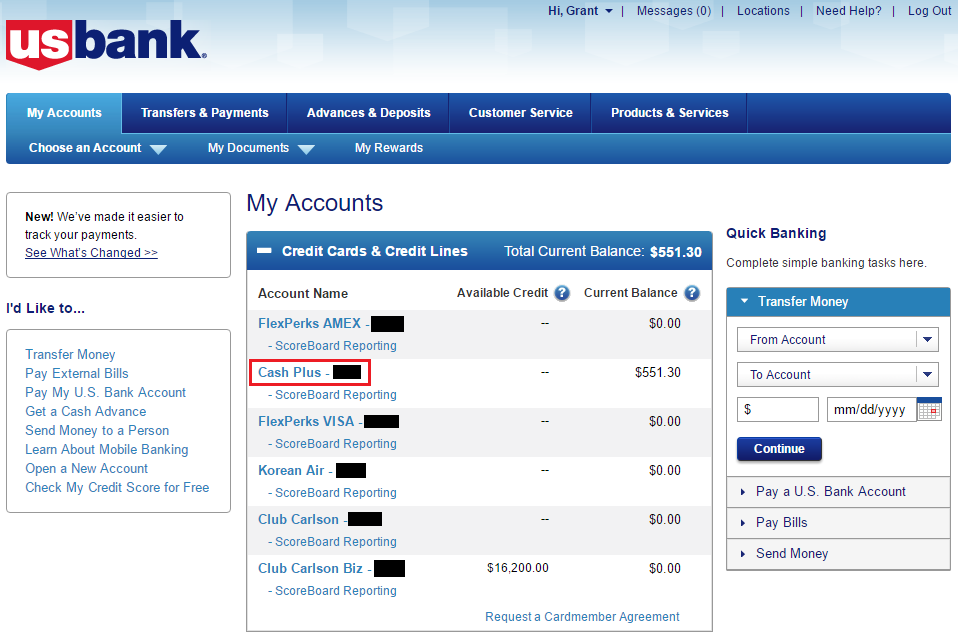

File Bankruptcy A case of bankruptcy is highly recommended a last resort. If you’re considering submitting personal bankruptcy to other reasons (personal credit card debt, scientific debts, death of earnings), a case of bankruptcy can get care for a home loan material along with. About contour lower than, both parties is actually linked to the financial you to definitely retains the borrowed funds into the property. When you file for bankruptcy, you can dump for you to decide on mortgage if you give up your own legal rights towards assets. You might not any longer get involved in it diagram. Personal bankruptcy makes you cure your self on the photo less than the to each other.

0 Comments