payday loan for terrible credit

6. When you need brief money having a crisis expense

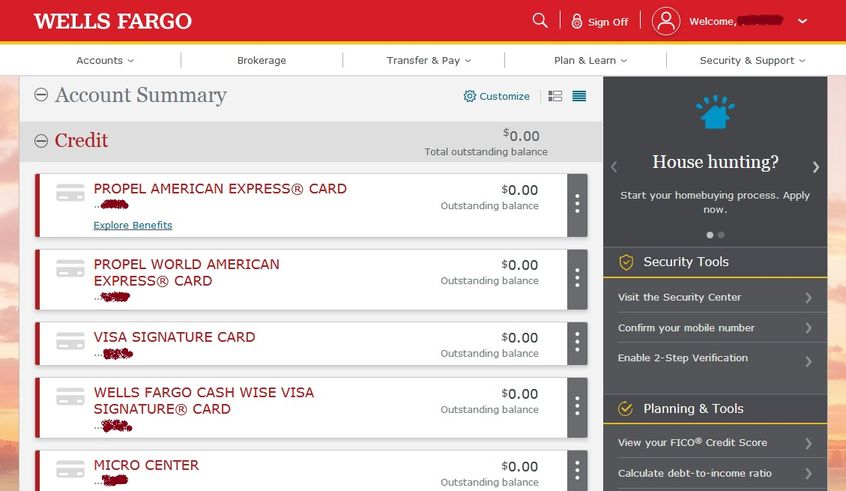

If you are balancing numerous higher-focus expenses, utilizing your household equity to combine them would be an intelligent financial method. Household security money and you may HELOCs often have down rates of interest compared with other lending products, potentially saving you cash on focus over time. Less rate of interest you will definitely mean lower monthly installments, freeing up cash in your finances.

Like, when you yourself have balance towards the numerous higher-desire playing cards otherwise personal loans, you might be able to pay them all out-of from the combining which have an individual household collateral financing. This could end in step one fixed-speed, lower-interest payment unlike numerous variable, higher-desire money.

Merging multiple expenses into step 1 mortgage normally explain your money, making it simpler to deal with costs. That have a set payment name offer a very clear road to as debt-totally free. Simply keep in mind that you might be with your home since the guarantee, so it is important to be assured that it is possible to make the financing repayments. (more…)