Here are the newest refinancing financing prices in the market

If you are considering refinancing your mortgage to snag a lower life expectancy attract rates, we wish to be the cause of the variety of costs which can come to you to cease any unexpected situations on the track.

And work out lifestyle just that bit easier for you, let me reveal a convenient guide that may look at the popular charge and you can costs to expect whenever refinancing, and just have a good Q&A with financial professional Heidi Armstrong.

Costs away from refinancing a mortgage

There are many different upfront charge and you can will set you back to watch out for whenever refinancing a home loan. Since costs of them additional costs can vary based the lender, here are a few of the simple initial refinancing charges you’ll be able to have to take into account.

Break fees

When you have a predetermined-speed financial and you are clearly looking to refinance when you look at the repaired-rate period, you are going to most likely happen a rest percentage.

These costs security people death of earnings the lender possess sustained as a result of the incompletion of your arranged repaired term.

- The loan matter

- Just how long remaining on repaired identity

- The latest fixed speed as compared to most recent varying field rates

Early exit charge

The fresh Gillard Authorities banned loan providers from recharging very early get-off fees towards the money applied for immediately after . So, when you have borrowed your loan before now, you may be required to shell out an exit payment.

The expenses for this kind of payment can range anywhere between $0 in order to $7,000. It is suggested to make contact with your existing bank to discuss whether hop out costs may apply to you.

Application/institution charge

If you’re refinancing that have a separate financial, they could ask you for a software commission that can vary from $0 so you can $step 1,000. Sometimes, lenders tend to negotiate if you don’t waive the fee in order to vie for your needs.

Property valuation costs

Brand new valuation payment will be based upon the financial institution therefore the precise location of the assets. For instance, outlying qualities are apt to have highest valuation charges compared to those inside the urban areas because of basic facts e.grams. https://www.paydayloancolorado.net/cascade-chipita-park/ travel big date.

As a rough book, a valuation can cost as little as $fifty and also as much as $775. Specific loan providers could even through the valuation prices regarding software commission.

Settlement charge

If you cannot share with because of the term, funds percentage are paid back to some other lender to settle the loan. They covers the cost of the financial institution arranging to possess a legal member to visit the borrowed funds alongside the consumer in addition to their conveyancer otherwise solicitor.

Discharge costs

Also known as a cancellation commission, a mortgage release percentage relates to exterior refinances which can be in which the lending company may ask you to pay discharge costs to cover the newest administrator charge needed to end this new package.

Financial subscription fees

Home financing membership payment was energized of the state and you will area governments to join up the property while the protection towards a property loan. This means that, it provides the financial institution the legal right to offer the house if the the consumer cannot outlay cash back.

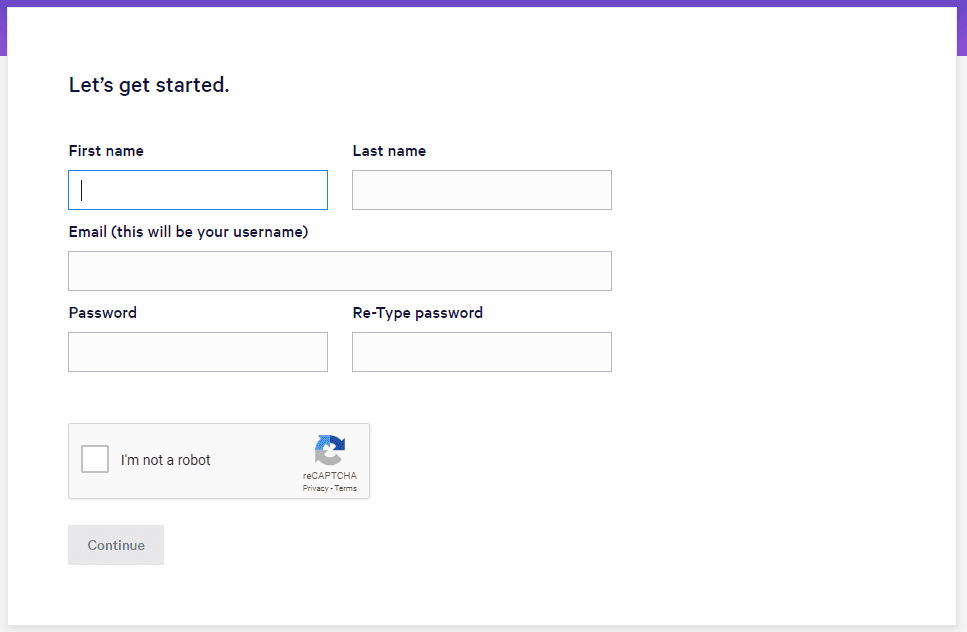

Foot standards of: an excellent $eight hundred,000 loan amount, adjustable, repaired, prominent and attract (P&I) home loans that have an LVR (loan-to-value) ratio of at least 80%. not, brand new Contrast Domestic Loans’ table allows for data to-be produced to your variables while the chose and input by the associate. Particular facts might be noted since the advertised, featured or sponsored that can arrive plainly from the dining tables no matter of the characteristics. All the issues tend to checklist this new LVR towards the equipment and you may price which happen to be demonstrably penned towards unit provider’s webpages. Month-to-month repayments, given that ft criteria is actually altered by user, depends on chose products’ claimed prices and you will computed from the loan amount, cost sorts of, mortgage title and you may LVR given that type in by member/your. *The latest Analysis rates is dependent on a great $150,000 mortgage over twenty five years. Warning: which comparison price holds true simply for this case that will maybe not become all the fees and you may costs. More words, fees or other loan quantity might result when you look at the yet another investigations rates. Prices right as of .

0 Comments